If you like this article then please like us on Facebook so that you can get our updates in future ……….and subscribe to our mailing list ” freely “

Are held for use in the production or supply of goods or services, for rental to others, or for administrative purposes; and Are expected to be used during more than a period of twelve months.

Accounting Standard 10 (AS 10) – Property, Plant and Equipment

The cost of an item of PPE should be recognised as an asset if, and only if:

(a) it is probable that future economic benefits associated with the item will flow to the enterprise; and (b) the cost of the item can be measured reliably.

Important Update –

Download Revised AS 10 Handwritten Notes in PDF

Measurement at recognition

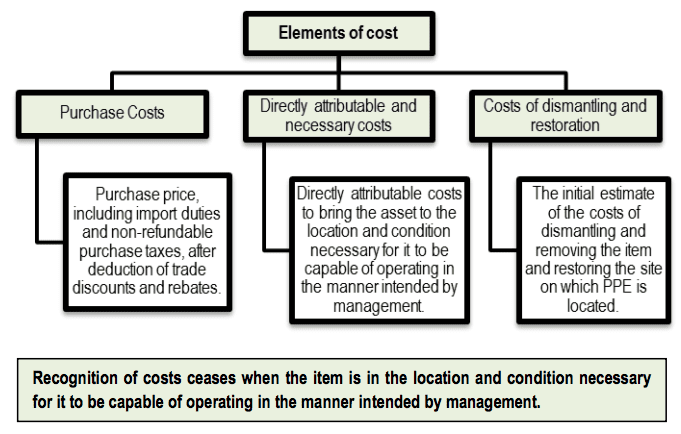

At the time of recognition, an item of PPE that qualifies for recognition as an asset should be measured at its cost.

Examples of Directly Attributable Costs:

Costs of employee benefits arising directly from the construction or acquisition of the item of PPECosts of site preparationInitial delivery and handling costsInstallation and assembly costsProfessional feesCosts of testing whether the asset is functioning properly , after deducting the net proceeds from selling any items produced while bringing the asset to that location and condition (such as samples produced when testing equipment)

Exclusions:

Administration and other general overhead costsCosts of opening a new facility or business, such as, inauguration costsCosts of introducing a new product or service (including costs of advertising and promotional activities)Costs of conducting business in a new location or with a new class of customer (including costs of staff training)

PPE acquired in exchange for a non-monetary asset or assets, or a combination of monetary and non-monetary assets The cost of such an item of PPE is measured at fair value unless:

(a) the exchange transaction lacks commercial substance; or(b) the fair value of neither the asset(s) received nor the asset(s) given up is reliably measurable.

The acquired item(s) is/are measured in this manner even if an enterprise cannot immediately derecognise the asset given up. If the acquired item(s) is/are not measured at fair value, its/their cost is measured at the carrying amount of the asset(s) given up.

♣ Deferred Payment Plan

If an item of PPE is acquired under deferred payment plan, the difference of cash price equivalent and total payment is recognised as interest over the period of credit unless such interest is capitalised as per AS 16, Borrowing Costs.

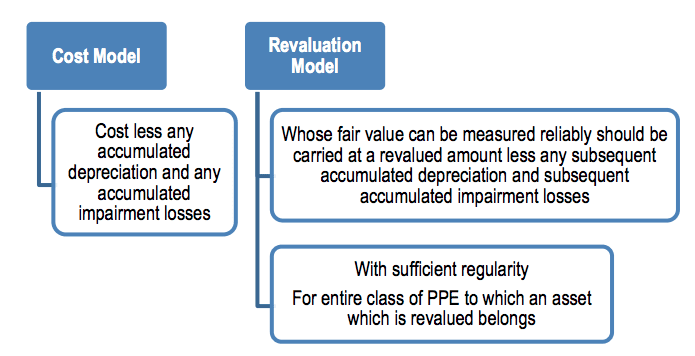

Measurement after recognition

An enterprise should choose either the cost model or the revaluation model as its accounting policy and apply that policy to an entire class of PPE. Accounting for Revaluations

Increase in an asset’s carrying amount as a result of a revaluation is credited directly to owners’ interests under the heading of revaluation surplus. However, the increase should be recognised in the Statement of Profit and Loss to the extent it reverses a revaluation decrease of the same asset previously recognised in the Statement of Profit and Loss.Decrease in an asset’s carrying amount as a result of a revaluation is recognised in the Statement of Profit and Loss. However, the decrease should be debited directly to owners’ interests under the heading of revaluation surplus to the extent of any credit balance existing in the revaluation surplus in respect of that asset.

Depreciation

Each part of an item of PPE with a cost that is significant in relation to the total cost of the item should be depreciated separately.The depreciable amount should be allocated on a systematic basis over its useful life.Depreciation charge for each period should be recognised in the Statement of Profit and Loss unless it is included in the carrying amount of another asset.Residual value & useful life to be reviewed at each balance sheet date. Any change is accounted for as change in an accounting estimate as per AS 5.Depreciation method used should reflect the pattern in which the asset’s future economic benefits are expected to be consumed by the enterprise.Depreciation method to be reviewed at least at each financial year end. Any change is accounted for as change in an accounting estimate as per AS 5.Depreciation methods include SLM, WDV & Units of Production method.

Retirements Items of PPE retired from active use and held for disposal should be stated at the lower of their carrying amount and net realisable value. Any write-down should be recognised immediately in the Statement of Profit and Loss. Derecognition

The carrying amount of an item of PPE should be derecognised on disposal or when no future economic benefits are expected from its use or disposal.Gain/loss on derecognition should be recognised in Statement of Profit and Loss (unless AS 19 requires otherwise in a sale and leaseback) and should not be classified as revenue.Gain/loss on derecognition is the difference between net disposal proceeds, if any, and the carrying amount of the derecognised item of PPE.

Recommended Read –

AS 12 Accounting for Government GrantsAccounting Standard 13 Accounting for investmentsAccounting Standard 16 – Accounting for Borrowing CostsDownload Accounting Standard 22AS 1 – Disclosure of Accounting PoliciesCA Final Result CA IPCC Result