Reconciliations between the tax records and audited statements of accounts are generally sought for at the time of assessment, audit or investigation by the Revenue authorities. There is no statutory requirement to furnish such reconciliation statements under the present laws In India, the tax compliances by most tax payers leave a lot to be desired. Therefore, while the information provided by the tax payer would be accepted at its face value, there have to be certain checks and balances put in place to ensure that no tax leakages take place due to inadequate information of tax laws, negligence in maintaining records, human or technical errors and fraud.

Audit under GST can be of following two types:

AUDIT BY TAX AUTHORITIES:

- Who has power to conduct Audit?

The Commissioner or any other officer authorized by him may undertake AuditThrough General or Specific orderFor Financial year or Multiples thereof [rule 101].

- What are transactions that are verified in Audit?

Outward SupplyInward SupplyAvailment of CreditPayment of tax is made and declared in returnGSTR Returns and reconciliation with records maintained.Other Compliances with the Law

- Where Audit will be conducted?

At place of business of Registered Person orIn their own office

- What is period & format of Notice? [Section 65 (3) & Rule 101 (2)]

Not less than 15 days noticeprior to conduct of auditIn Form GST ADT- 01Notice to specify period for which audit is to be conducted

- What is Time Limit for conduct of Audit ?[Section 65(4)

To be completed within 3 months of commencement of date of auditExtension can be granted by CommissionerFor period not exceeding 6 months ( Reasons to be recorded in writing)

- What is the meaning of Commencement of Audit?

Date on which records and other documents, called for by the Tax Authorities.Are made available by the registered person orActual institution of auditWhichever is later

- What assistance is to be provided by Registered Person? [Sec 65(5)]

To afford necessary facility to verify books/ documentsFurnishing the information required andRendering assistance for completion of audit.

- How & When Audit Findings are to be intimated by Proper Officer [Sec 65(6 & 7)]?

Proper Officer in Form ADT-02 inform within 30 days of completion of audit;Audit Findings & Reasons thereofRegistered Person rights & Obligations

- Proceedings may be initiated U/s 73 or 74? If audit report reveals Tax not paid/Short paid/ Excess ITC Claimed/Excess Refund Claimed than

Proceedings U/s 73 – Normal CasesProceedings U/s 74 – Fraud Cases

Special Audit under GST Regime

- When Can Special Audit be ordered? [Sec 66 (1) + Rule 102] During any stage of scrutiny, enquiry, investigation or any other proceeding Officer not below the rank of AC, if he is of opinion that:

Value declared is not correct orCredit availed is not within normal limit,

With prior approval of Commissioner

Issue directions for Audit in ADT-03

- Who can conduct Special Audit? [Sec 66(1)]

Chartered Accountant or Cost AccountantAs may be nominated by Commissioner.

FEATURES OF SPECIAL AUDIT:

- What is time limit for period of submission of Audit Report? [Sec 66(2) + Rule 102]

Within 90 daysChartered Accountant or Cost Accountant required to submit to ACReport duly signed and certifiedFor sufficient reasons, extension of another 90 days allowed on an application by registeredPerson or CA/ CWAFindings to be communicated in Form GST ADT04Can be conducted in addition to other Audit.Principal of Natural justice to be followed – Opportunity of being heardExpenses of Audit to be determined & paid by Commissioner.PO may initiate proceedings u/s 73 or 74 if audit report reveals Tax not paid / Short paid / Excess ITC Claimed / Excess Refund claimed.Provisions of Special Audit under GST are broadly similar to provisions contained in erstwhile.Indirect taxation regime [Sec 14A of Central Excise Act and Section 72A of ServiceTax]

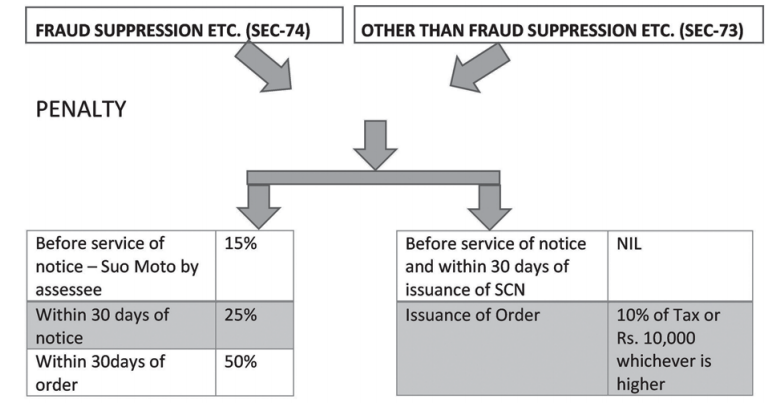

Penal Provision:

(For Audit by Tax Authorities & Special Audit):

Annual Audit

- Which assesses is liable for Annual Audit? Every Registered person whose aggregate turnover during a FY exceeds the prescribed limit (INR 2 Crores) shall get his accounts audited by a CA or ICWA and shall submit:

a copy of the audited annual accounts,the reconciliation statement under Sec 44(2) in GSTR-9C andSuch other documents in such form and manner as may be prescribed.

- What is Aggregate Turnover for Annual Audit? The aggregate value of:

All taxable supplies (excluding the value of inward supplies on which tax is payable by a person on reverse charge basis)Exempt supplies [includes non taxable supplies]Exports of goods or services or both andInter-state supplies [inter-state stock transfers] of persons having the samePermanent account number to be computed on all India basis butexcludes central tax, state tax, union territory tax, integrated tax and cess.

- What accounts and records to be maintained? [Sec 35(1) + Rule 56] Every registered person shall keep and maintain, at his principal place of business, as mentioned in the certificate of registration, a true and correct account of:

Production or Manufacture of goods (Quantitative details);Provision of Services (Inputs Services & Services Supplied)Inward and outward supply of goods or services or both;Stock of goods?Particulars of the opening balance, receipt, supply, goods lost, stolen, destroyed, written off or disposed of by way of gift or free sample and the balance of stock including raw materials, finished goods, scrap and wastage thereofInput tax credit availed;Output tax payable and paid; andGoods or services imported or exportedSupplies attracting RCM along with Relevant documentsAdvance Received & Paid along with AdjustmentsComplete Supplier & Customer MasterList of all Additional Place of Business & Other Warehouses

Q4) How Reconciliation is to be done in Annual Audit?

Monthly Return Vs Annual ReturnAnnual Return Vs Audited FinancialsMonthly Returns Vs Audited Financials

Q5) What are Challenges under Annual Audit GST law has taken care of the strong audit mechanism, but some ambiguity is still unanswered:

The assesses having multiple states should have a centralized audit or should undergo multiple audits, no clarity over the procedure. Manual audit should be conducted or e-audit.Taxable persons, the frequency at which audit should be conducted is not specified.Is the response to be submitted manually or electronically?

CONCLUSION: Under the GST law, the provisions related to audit are simple but need some more clarity on various aspects, which are likely to come in due course and we also look forward to some relaxation for small taxpayers. Recommended Articles

GST ScopeGST ReturnGST FormsGST RateGST RegistrationWhat is GST?GST Invoice FormatGST Composition SchemeHSN CodeGST LoginGST RulesGST StatusTrack GST ARNTime of Supply

If you have any query or suggestion regarding “Audit under GST Regime, Audit in GST Law” then pelase tell us via below comment box…