If you like this article then please like us on Facebook so that you can get our updates in future ……….and subscribe to our mailing list ” freely “

Budget Updates 2021

The Last Date for filing belated, revised return is proposed to be reduced by three months in Budget 2021 from March 31 of the relevant assessment year to Dec 31 of the assessment year. As per the proposal, this means that the last date for voluntarily filing the ITR for the current financial year, i.e., FY 2020-21 will be December 31, 2021. Normally, income tax returns for a financial year have to be filed by July 31 of the following financial year (called the assessment year). Currently, belated and revised ITRs can be filed voluntarily after the normal deadline, up to March 31 of the assessment year.

Belated Return Section 139(4)

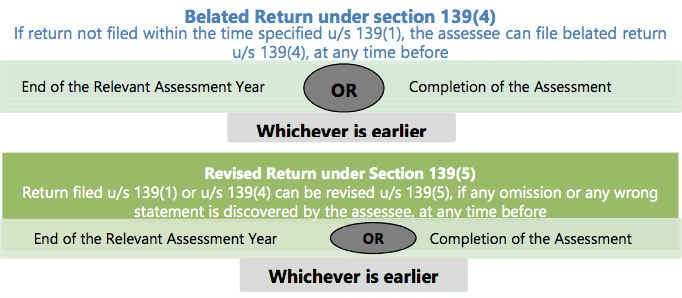

As per the provisions of section 139(1), it is compulsory for every assessee to file a return of income or loss for every previous year on or before the due date prescribed , if their income exceeds basic exemption limit. A return of income for any previous year, which has not been furnished within the time allowed u/s 139(1), may be furnished at any time before the:

(i) end of the relevant assessment year; or(ii) completion of the assessment,

whichever is earlier And the due dates for filing of return of income are as under :

Belated Return Section 139(4) Due Dates

If the tax payer has not filed the return then the tax payer receives a notice of enquiry under section 142(1) or notice of Escaping income under section 148. In such case he should file the return within the date specified in the notice. If the assessee is failed to furnish the return of income within the time allowed to him under section139(1) or within the time allowed through the notice issued under section 142(1) can furnish their return for any previous year. This return is called as “belated return”. And this can be filed (1) On any day Before the expiry of one year from the end of the relevant assessment year Or (2) On any day Before the completion of the assessment year. Which ever is Earlier There is no much difference in the process of filing Income Tax return within the due date and after the due date. One just needs to mention in ITR form that it is a belated return under 139(4). While filing the ITR, select the return filed section code as “12” in the tax return form.

Consequences arising due to belated return :

(1) Once a belated return is filed then it can’t be revised further. (2) Assessee cannot carry forward the losses incurred during the head under ‘Capital Gains’ or ‘Profits and Gains of Business/ Profession’ (3) Assessee may have to pay interest under section 234A @ 1% per month or part thereof of delay in filing the return. (4) If the assessee is eligible for refund and interest on that refund then he won’t be able to receive the interest on the refundable amount. (5) If the return is filed one year after the end of the financial year, then the income tax officer can levy a penalty up to Rs. 5,000 for the delay.

Example

Mr. Vineet submits his return of income on 12-09-2020 for A.Y 2020-21 consisting of income under the head salaries, “Income from house property” and bank interest. On 21-01-2021, he realized that he had not claimed deduction under section 80TTA in respect of his interest income on the Savings Bank Account. He wants to revise his return of income. Can he do so? Examine. Would your answer be different if he discovered this omission on 21-04-2021?

Solution

Since Mr. Vineet has income only under the heads “Salaries”, “Income from house property” and “Income from other sources”, he does not fall under the category of a person whose accounts are required to be audited under the Income-tax Act, 1961 or any other law in force. Therefore, the due date of filing return for A.Y. 2020-21 under section 139(1), in his case, is 31st July, 2020. Since Mr. Vineet had submitted his return only on 12.9.2020, the said return is a belated return under section 139(4). As per section 139(5), a return furnished under section 139(1) or a belated return u/s 139(4) can be revised. Thus, a belated return under section 139(4) can also be revised. Therefore, Mr. Vineet can revise the return of income filed by him under section 139(4) in January 2021, to claim deduction under section 80TTA, since the time limit for filing a revised return is upto the end of the relevant assessment year, which is 31.03.2021. However, he cannot revise return had he discovered this omission only on 21-04- 2021, since it is beyond 31.03.2021, being the end of A.Y. 2020-21. Recommended Articles

Research & Development CessCommission payable to foreign agents – Taxability ?Commercial PapersSenior citizens savings schemeSection 44AD – Tax on Presumptive Basis