Introduction

The Cost of Capital is the most important and controversial area in Financial Management. Capital Budgeting decisions have a major impact on the firm, and Cost of Capital is used as a criterion to evaluate the capital Budgeting decisions i.e., whether to accept or reject a project. Knowledge about cost of capital, and how it is influenced by financial leverage, is useful in making capital structure decisions. The cost of capital is the most important concept in financial decision making. The chief objective of measuring the cost of capital is its use as a decision criterion in capital budgeting.

Cost of Capital

For an investment to be worthwhile, the expected return on capital must be greater than the cost of capital. The cost of capital is the rate of return that capital could be expected to earn in an alternative investment of equivalent risk. If a project is of similar risk to a company’s average business activities it is reasonable to use the company’s average cost of capital as a basis for the evaluation. A company’s securities typically include both debt and equity; one must therefore calculate both the cost of debt and the cost of equity to determine a company’s cost of capital. However, a rate of return larger than the cost of capital is usually required. The WACC is the minimum return that a company must earn on an existing asset base to satisfy its creditors, owners, and other providers of capital, or they will invest elsewhere. Companies raise money from a number of sources: common equity, preferred equity, straight debt, convertible debt, exchangeable debt, warrants, options, pension liabilities, executive stock options, governmental subsidies, and so on. Different securities, which represent different sources of finance, are expected to generate different returns. The WACC is calculated taking into account the relative weights of each component of the capital structure. The more complex the company’s capital structure, the more laborious it is to calculate the WACC.

Definition of Cost of Capital:

Cost of Capital is the minimum rate of return that must be earned on investments, in order to meet the rate of return required by the investors. It is the discount rate applied to evaluate the firm’s capital projects. According to Professor I.M.Pandy “Cost of Capital is the discount rate used in evaluating the desirability of the investment project”. The cost of capital is the minimum rate of return required for investment project. The cost of capital is the minimum rate of return which will maintain the market value per share at its current level. If the firm earns more than the cost of capital, the market value per share is expected to increase. In other words, it is the rate that suppliers of funds expect to get. It is determined by the cost of the various sources of finance. It is also referred to as the weighted average cost of capital or composite/combined cost of capital.

Importance of Cost of Capital

The Cost of Capital is very important in Financial Management and plays a crucial role in the following areas:

(i) Capital budgeting decisions: The cost of capital is used for discounting cash flows under Net Present Value method for investment proposals. So, it is very useful in capital budgeting decisions.(ii) Capital structure decisions: An optimal capital is that structure at which the value of the firm is maximum and cost of capital is the lowest. So, cost of capital is crucial in designing optimal capital structure.(iii) Evaluation of final Performance: Cost of capital is used to evaluate the financial performance of top management. The actual profitably is compared with the actual cost of capital of funds and if profit is greater than the cost of capital the performance nay be said to be satisfactory.(iv) Other financial decisions: Cost of capital is also useful in making such other financial decisions as dividend policy, capitalization of profits, making the rights issue, etc.

Classification of Cost of Capital

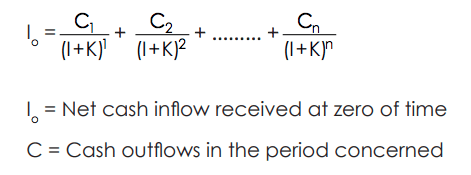

Cost of Capital can be classified as follows: (i) Historical Cost and Future Cost: Historical costs are book costs relating to the past, while future costs are estimated costs act as guide for estimation of future costs. (ii) Specific Costs and Composite Costs: Specific cost is the cost of a specific source of capital, while composite cost is combined cost of various sources of capital. Composite cost, also known as the weighted average cost of capital, should be considered in capital and capital budgeting decisions. (iii) Explicit and Implicit Cost: Explicit cost of any source of finance is the discount rate which equates the present value of cash inflows with the present value of cash outflows. It is the internal rate of return and is calculated with the following formula;

K = Explicit cost of capitalN = Duration of time period

Implicit cost also known as the opportunity cost is the opportunity foregone in order to take up a particular project. For example, the implicit cast of retained earnings is the rate of return available to shareholders by investing the funds elsewhere. (iv) Average Cost and Marginal Cost: An average cost is the combined cost or weighted average cost of various sources of capital. Marginal cost refers to the average cost of new or additional funds required by a firm. It is the marginal cost which should be taken into consideration in investment decisions.

Market Value AddedCapital Budgeting