Find Complete List of Documents required for GST New Registration in India. Check List of Documents Accepted as Address Proof for GST Registration, Documents Required for GST Registration for Business Premises, Individuals, HUF’s, Company, Trusts, Local Authority, Local Body, Proprietary Concern, Partnership Firm etc. Now Scroll down below n check more details for “Documents Required for GST Registration in India – Complete List”

Documents Required for GST Registration in India

Important Articles Related to GST Registration

GST New Registration ProcedureGST RegistrationSystem Requirements for Using the GST PortalGST Enrollment Procedure on GST Portal

Documents required for GST New Registration

The requirement of documents for fresh GST registration is depends upon the type of entity. Each type of entity has separate prerequisites of documents which have to be submitted online at the GST portal. To complete the GST enrolment process please keep the following document ready: Detailed information on proofs required to be attached on the basis of Constitution of Business selected by Applicant. In case you are unable to upload any document, check the Internet connectivity, file size and format of the document you are trying to upload Any Proof substantiating Constitution Any Proof substantiating Constitution While filling the details of <Promoters / Partners>, you are required to attach Photograph for each records entered. Maximum file Size for Photograph allowed is 100 KB and File Type must be JPEG only.]

Proof of Authorised Signatory:

Following documents are required.

Documents Required for Principal Place of Business:

Proof of Principal Place of Business

Documents Required for Bank Accounts

Documents Required – Proof of Details of Bank Accounts.

Documents Required for GST Enrolment In Detailed

Individual documents

PAN card and ID proof of the individual.Copy of Cancelled cheque or bank statement.

Registered Office documents

Copy of electricity bill/landline bill, water BillRent agreement (in case premises are rented)

Documents required for Private Limited Company (Pvt Ltd)/Public Company (limited company)/One person company (OPC): Company documents

PAN card of the companyRegistration Certificate of the companyMemorandum of Association (MOA) /Articles of Association (AOA)Copy of Bank StatementCopy of Board resolution

Director related documents

PAN and ID proof of directors

Registered Office documents

Copy of electricity bill/landline bill, water BillRent agreement (in case premises are rented)

Documents required for Normal Partnerships

Partnership documents

PAN card of the PartnershipPartnership DeedCopy of Bank Statement

Partner related documents

PAN and ID proof of designated partners

Registered Office documents

Copy of electricity bill/landline bill, water BillRent agreement (in case premises are rented)

Photographs (wherever specified in the Application Form)

Proprietary Concern – ProprietorPartnership Firm / LLP – Managing/Authorized/Designated Partners (personal details of all partners is to be submitted but photos of only ten partners including that of Managing Partner is to be submitted)HUF – KartaCompany – Managing Director or the Authorised PersonTrust – Managing TrusteeAssociation of Person or Body of Individual –Members of Managing Committee (personal details of all members is to be submitted but photos of only ten members including that of Chairman is to be submitted)Local Authority – CEO or his equivalentStatutory Body – CEO or his equivalentOthers – Person in Charge

Constitution of Taxpayer:

Partnership Deed in case of Partnership Firm, Registration Certificate/Proof of Constitution in case of Society, Trust, Club, Government Department, Association of Person or Body of Individual, Local Authority, Statutory Body and Others etc.

Proof of Principal/Additional Place of Business:

(a) For Own premises – Any document in support of the ownership of the premises like Latest Property Tax Receipt or Municipal Khata copy or copy of Electricity Bill. (b) For Rented or Leased premises – A copy of the valid Rent / Lease Agreement with any document in support of the ownership of the premises of the Lessor like Latest Property Tax Receipt or Municipal Khata copy or copy of Electricity Bill. (c) For premises not covered in (a) & (b) above – A copy of the Consent Letter with any document in support of the ownership of the premises of the Consenter like Municipal Khata copy or Electricity Bill copy. For shared properties also, the same documents may be uploaded.

Bank Account Related Proof

Scanned copy of the first page of Bank passbook / one page of Bank Statement Opening page of the Bank Passbook held in the name of the Proprietor / Business Concern – containing the Account No., Name of the Account Holder, MICR and IFSC and Branch details.

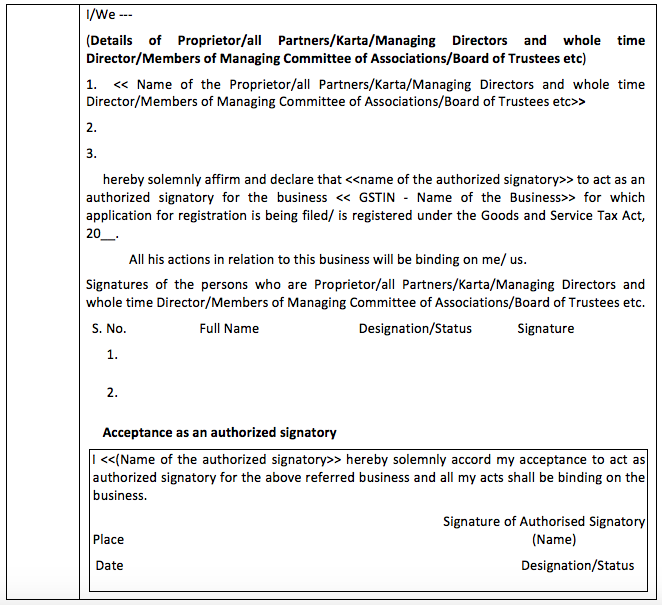

GST Authorization Letter Form:-

For each Authorised Signatory mentioned in the application form, Authorization or copy of Resolution of the Managing Committee or Board of Directors to be filed in the following format: Must Download – GST Registration Consent Letter, Authorization Letter Format Declaration for Authorised Signatory (Separate for each signatory)

Instruction for filling Application for New Registration

Enter Name of taxpayer as recorded on PAN of the Business. In case of Proprietorship concern, enter name of proprietor at Legal Name and mention PAN of the proprietor. PAN shall be verified with Income Tax databaseProvide Email Id and Mobile Number of primary authorized signatory for verification and future communication which will be verified through One Time Passwords to be sent separately, before filling up Part-B of the application.Applicant need to upload scanned copy of the declaration signed by the Proprietor/all Partners/Karta/Managing Directors and whole time Director/Members of Managing Committee of Associations/Board of Trustees etc. in case the business declares a person as Authorised Signatory.

Recommended Articles

GST RefundGST ReturnGST FormsGST RateGST RegistrationWhat is GST?GST Invoice FormatITC under GSTHSN CodeGST LoginGST RulesGST StatusTrack GST ARNTime of Supply