Procedure for How to Verify Income Tax Return by Using Aadhaar Card, There are three options are available for Taxpayers for e-verification of ITR. Option 1 – I already have an EVC to e-Verify my return., Option 2 – I do not have an EVC and I would like to generate EVC to e-Verify my return., Option 3 – I would like to generate Aadhaar OTP to e-Verify my return. Here we are providing complete procedure for “E-Verification of Income Tax Return” with Screenshots. If you like this article then please like us on Facebook so that you can get our updates in future ……….and subscribe to our mailing list ” freely “

E-Verification of Income Tax Return

Electronic Verification Code (EVC) for electronically filed Income Tax Return Choose any one of the following option to verify the Income Tax Return:

Digital Signature Certificate (DSC). If you do not have DSCAadhaar OTPEVC using Prevalidate Bank Account DetailsEVC using Prevalidate Demat Account DetailsAlready generated EVC through My Account Rs Generate EVC Option or Bank ATM. Validity of such EVC is 72 hours from the time of generationDon’t Want to e-verify this Income Tax Return and would like to send signed ITR-V to Bengaluru

Taxpayer will get an option to enter OTP for e-verifying the ITR, if an EVC or Aadhaar OTP option is chosen or To attach DSC, if DSC option is chosen to e-verify the ITR. After successful submission, ITD will process your ITR and send an email confirmation stating the same. The Electronic Verification Code (EVC) would verify the identity of the person furnishing the return of income through e-Filing. The EVC can be used by a Verifier being an Individual to verify his Income Tax Return or that of an HUF of which he is the Karta in Income Tax Return Form 1, 2, 2A, 3, 4 or 4S or the Income Tax Return Form filed in ITR 5 or 7 of any person in accordance with Section 140 of the Income Tax Act 1961.

e-Verification Process Flow

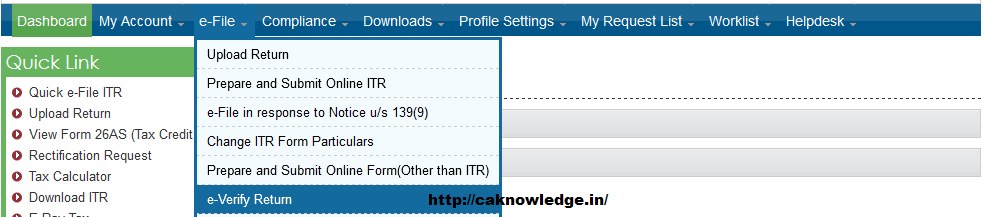

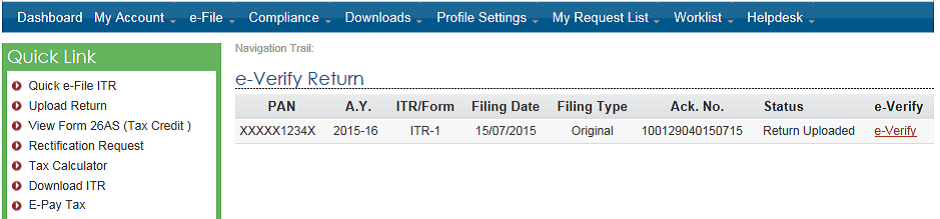

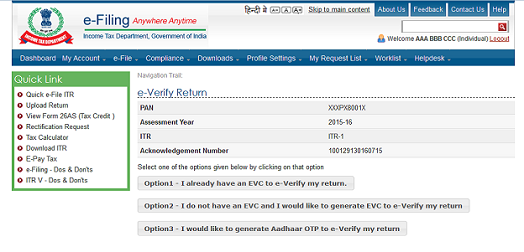

Step 1: Login to e-Filing Portal Step 2: Click “e-File” – Select “e-Verify Return” to view the Returns pending for e-Verification. Step 3: Click on “e-Verify” link to e-Verify the return. The Taxpayers are provided with three options if the return is already filed.

Option 1 – “I already have an EVC to e-Verify my return.”Option 2 – “I do not have an EVC and I would like to generate EVC to e-Verify my return.”Option 3 – “I would like to generate Aadhaar OTP to e-Verify my return.”

Option 1: “I already have an EVC to e-Verify my return”

Taxpayer once clicks on “I already have an EVC to e-Verify my return” than new screen is open with following textE-verify your ITR -1 FOR AY 2015-16 and Acknowledgement No………..,Now Taxpayer need to enter the pre generated EVC in the provided text box and Click “Submit “to e-Verify. No Further action required.

Option 2: “I do not have an EVC and I would like to generate EVC to eVerify my return”

Taxpayer once clicks on “I do not have an EVC and I would like to generate EVC to e-Verify my return” than new screen is open with following textSelect the appropriate option from from the buttons given below EVC – Through Net Banking EVC – To Registered Email ID and Mobile Number

Note: “If the Taxpayers Total Income is greater than 5 lakhs or if there is refund, Taxpayers are provided with only one option “EVC – Through Net Banking”

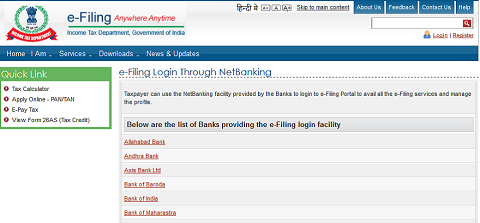

EVC – Through Net Banking:

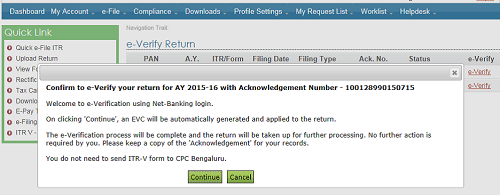

Click on “EVC – through Net Banking”Click on “Continue”, Taxpayer is logged out of e-Filing and will be redirected to the list of banks available for Net Banking Login

Login to e-Filing through NetBankingClick on “e-Verify” linkConfirm to e-Verify by clicking on Continue button.

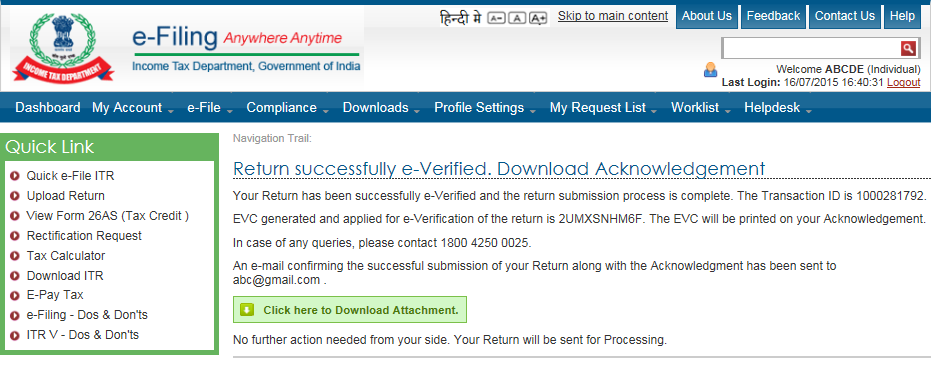

Success message will be displayed. No further action is required.

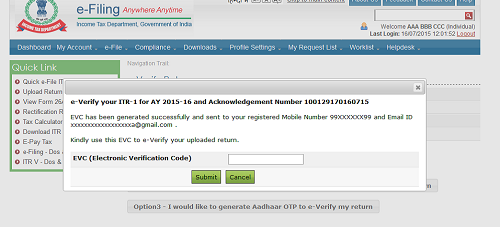

EVC – To Registered Email Id and Mobile Number

Click “EVC – to Registered Email Id and Mobile Number” (This option would be available for taxpayer whose Total income is Less than 5 Lakhs and there is no Refund)Enter the EVC received in your Mobile Number and Email Id in the provided text box and Click “Submit”. No Further action required

Success message will be displayed. No further action is required.

Option 3: “I would like to generate Aadhaar OTP to e-Verify my return.

Pre-requisite: To generate Aadhaar OTP, Taxpayer’s PAN and Aadhaar must be linked.

If the Taxpayer’s PAN and Aadhaar are not linked, the below pop up is displayed.

Click Link Aadhaar, taxpayer will be redirected to Link Aadhaar Page under Profile Settings – -Taxpayer to enter the Aadhaar Number to link his/her Aadhaar to PAN.

If the Taxpayer’s PAN and Aadhaar are linked, the below pop up is displayed.OTP is generated and sent to the Mobile Number registered with Aadhaar.Enter Aadhaar OTP in the text box provided and click on Submit. Success page is displayed. No further action is required.

Recommended

Belated Return & Revised ReturnIncome Tax Due DatesincometaxefilingAssessment Year (AY) & Previous Year (PY)Self Assessment TaxSubmission of Income Tax Return of a Deceased Assessee