As professionals, we all understand that any change in the economy along with the multiple problems brings a bag full of opportunities for businessmen and professionals both. Any change in the legal structure of the economy forces the professionals to go through a process of unlearning the current practices and re-learning the new processes. It’s the right time to jump on the bandwagon for us and determine a role that we can play in contributing to the success story of GST. Now check more details for “Steps to download and install emSigner Utility from GST Portal” below…

System pre-requisites for DSC Registration

Steps to download and install emSigner

EmSigner Utility

It is necessary to install Emsigner utility on the system to be able to use Digital Signature (DSC) for GST PurposeThe document is a step by step guide on how to download and install this e-signer utility

How to Download EmSigner Utility

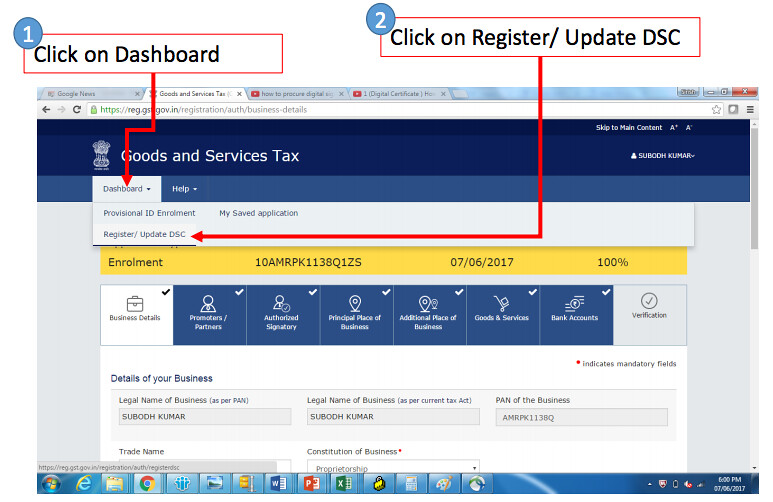

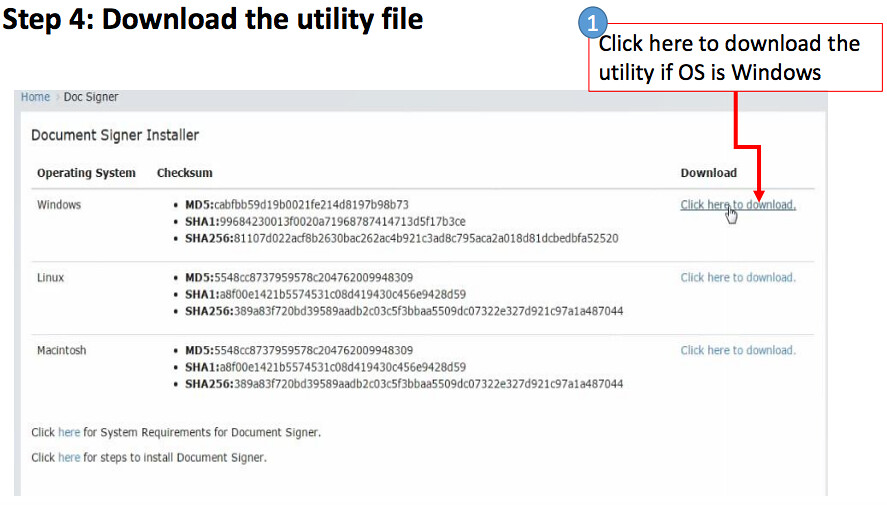

Step 1: Access GST Portal through www.gst.gov.in. Step 2: Click on the Register/Update DSC tab Step 3: Navigate to download the utility file Step 4: Download the utility file

How to Install emSigner Utility

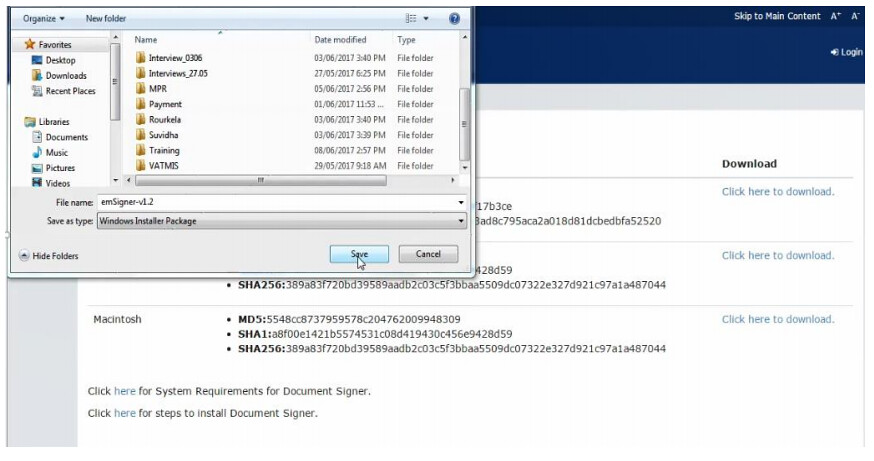

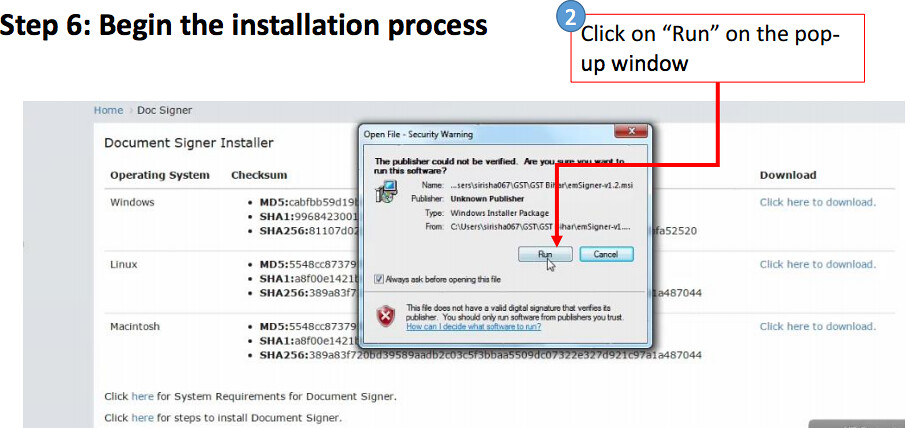

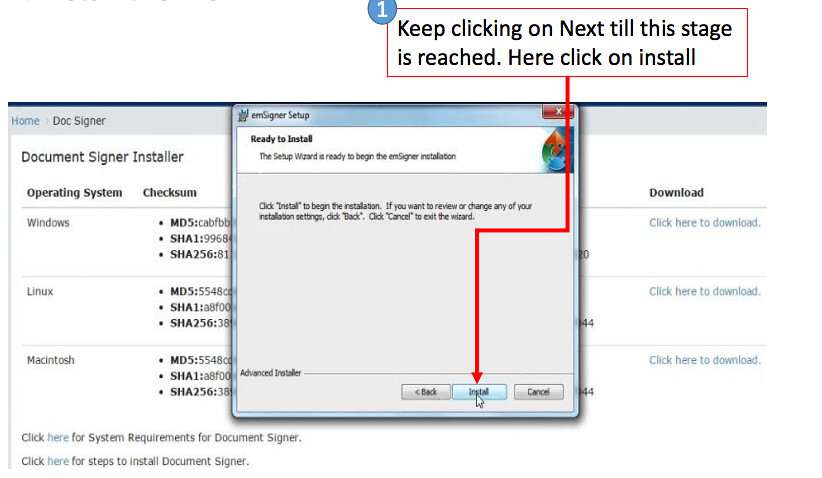

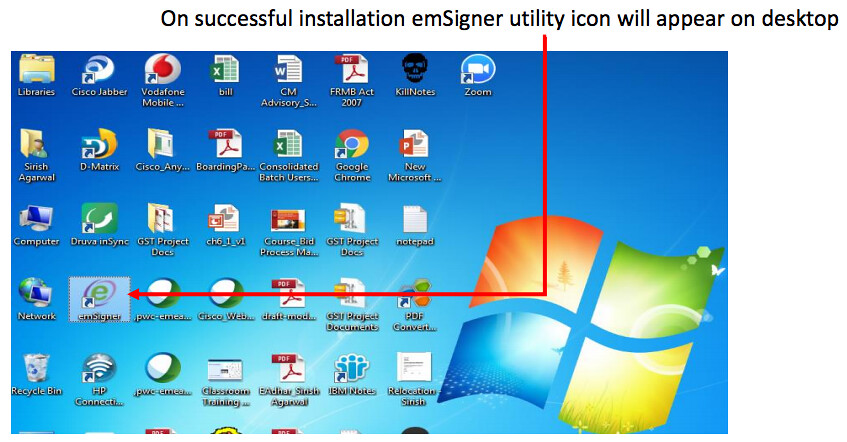

Step 5: Save the utility file Step 6: Begin the installation process (Click on “Run” on the popup window) Step 7: Install the file (Keep clicking on Next till this stage is reached. Here click on install) Step 8: Complete the installation process (Click on finish to complete the installation process) Step 9: Start emSigner utility (On successful installation emSigner utility icon will appear on desktop)

Run emSigner utility

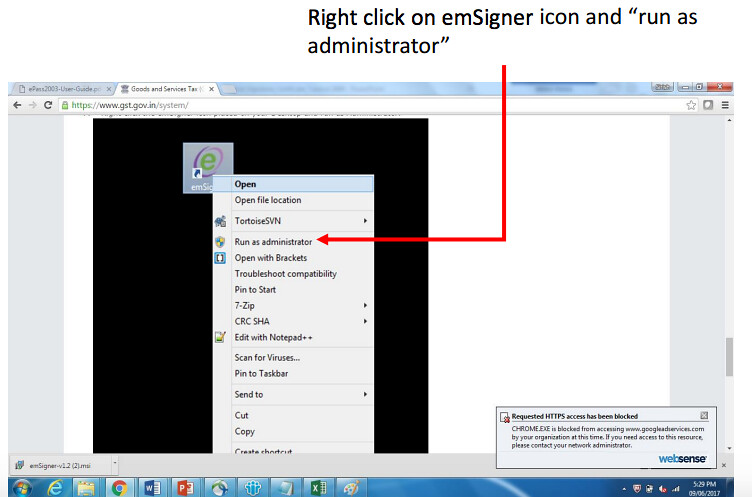

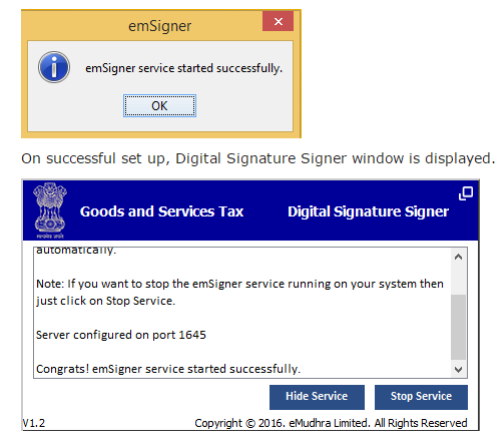

Step 9: Start emSigner utility (Right click on emSigner icon and “run as administrator”) Following message would be displayed once emSigner utility starts successfully. Now Digital Signature (DSC) can be used in GST Portal

Frequently Occuring Issues

Case 1: Primary Authorized Signatory is not checked Please ensure the checkbox at the bottom of the “proprietor details” tab should be checked or details of Authorized signatory should be filled Case 2: DSC not matching with Authorized Signatory Please ensure your Authorized signatory details match with the DSC details. Authorized signatory should be a person and not a firm or establishment name Case 3: Constitution of business Constitution of business must match with type of PAN Case 4: Cannot connect with emSigner server Right click on emSigner utility and “Run as administrator” If still not resolved – please try restarting your system Case 5: Pop-up of certification not visible Sometimes the popup to select certificate is not readily visible. Minimise the browser window and you may see the pop-up opened to select and sign the digital certificate.. Case 6: Internet browser related issues Sometimes the browser history and temp folder needs to be cleared for smooth operation. Process to clear temp folder Click on start (windows logo) -> type %temp% in Run -> go to temp folder and delete all the items

Register DSC for dealers migrated to GST

Activities to be completed from dealer’s side

Token should be in name of the authorized signatory, with details as filled in GST enrolment formAll tabs requiring dealer/business related information should be completely filled i.e profile should be 100% complete

Step 1: Insert the hard token device to one of the USB ports

For the first time, upon inserting the device a pop-up would ask you to run the setup and install certificateComplete the certificate installation process

Step 2: Access GST Portal through www.gst.gov.in Step 3: Navigate through the landing page Step 3: Navigate through the landing page Step 4: Click on the Register/Update DSC tab Step 5: Select the name of Authorized signatory Step 6: Select the digital signature certificate Step 7: Complete DSC registration process

PAN of authorized signatory is matched with CBDT. On successful match “your DSC has been successfully registered” message is displayed On unsuccessful match “ PAN not found in CBDT database” message is displayed

Step 8: Submit your application with DSC Step 9: Select the digital signature certificate and sign application To check detailed procedure for DSC Registration at GST Portal please check following link..

How to Register and Update Digital Signature (DSC) on GST Portal

Recommended Articles –

When will GST be applicableGST DefinitionReturns Under GSTGST RegistrationGST RatesGST Downloads:GST Forms:HSN Code ListGST LoginGST Registration last dateGST Due Dates: