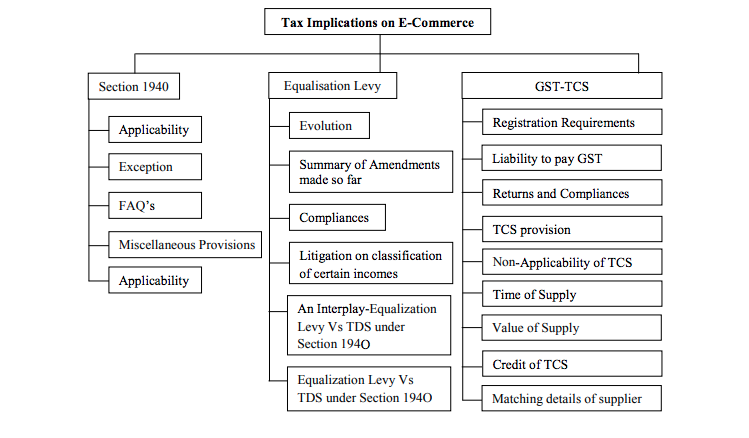

Tax Implications on E-Commerce Operators

TDS on e-commerce operators under section 194-O is applicable from 1 October 2020.

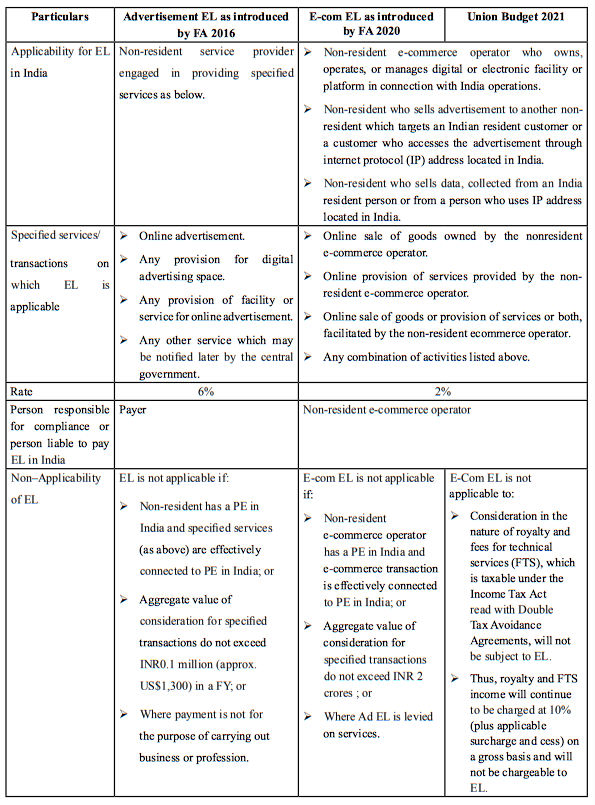

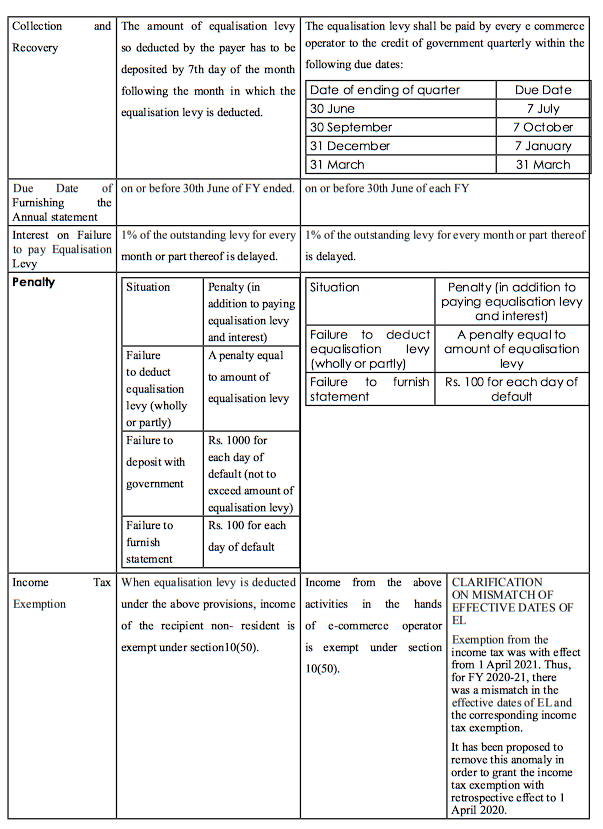

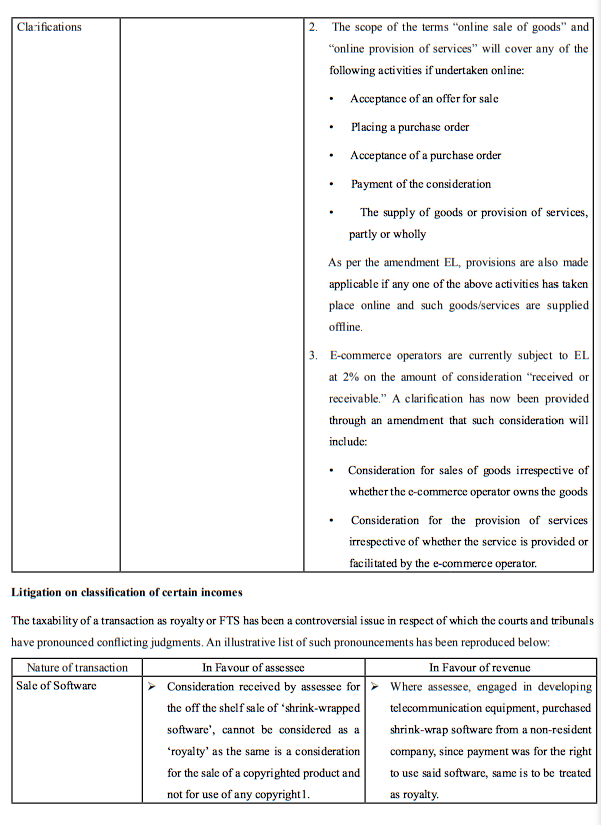

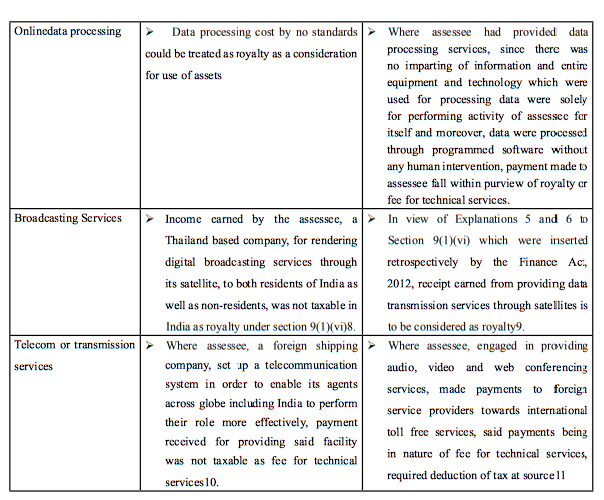

Equalization levy:

EL is levied on online sale of goods or online provision of services or a combination of both, by non-resident (NR) e-commerce operators (ECO), when online sale is made by a non-resident to specified persons. EL being charged at the rate of 2% on amount of consideration received or receivable by a non-resident ‘e-commerce operator’ from e-commerce supply or services as against 6% which was introduced earlier in 2016. Also, EL must be deposited by the NR ‘e-commerce operator’ and all related compliances viz. filing of EL return, etc. to be made by NR ‘e-commerce operator’.

TCS Mechanism under GST:

Tax Collected at Source (TCS) under GST means the tax collected by an e-commerce operator from the consideration received by it on behalf of the supplier of goods, or services who makes supplies through the operator’s online platform. TCS will be charged as a percentage on the net taxable supplies. The provision of TCS under GST is dealt under Section 52 of the CGST Act.

Definitions:

E-Commerce VS OIDAR:

Section 194O TDS on Payments Made to e-commerce Participants.

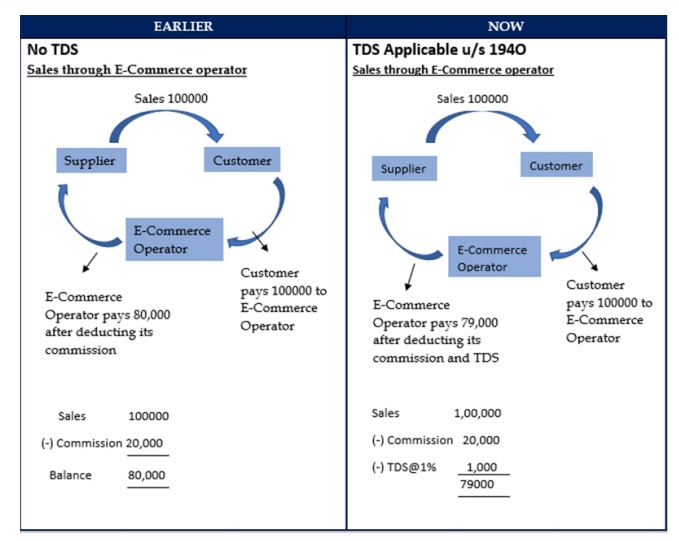

Law before 194O

Earlier, there was no TDS on payments made to e-Commerce participants. They were required to independently file their income tax returns. Therefore, many small e-Commerce participants did not file their ITR’s and escaped the tax liability. Section 194O has been introduced in the Union Budget 2020. And is applicable from 1 October 2020.

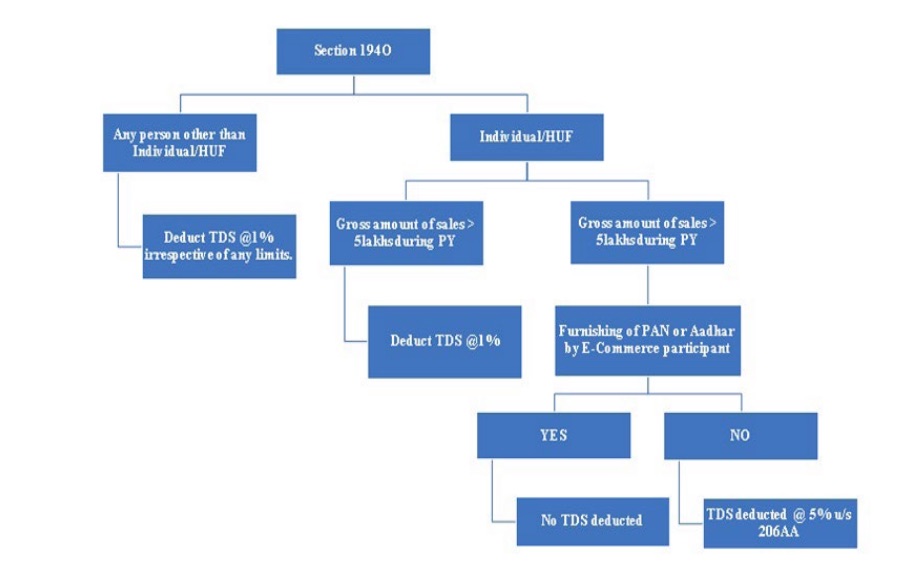

Applicability

- both resident and non-resident e-commerce operator.2. resident e-commerce participant

even if purchaser of goods/recipient of services is a non-resident. E-Commerce operators should deduct TDS @1% at the time of credit or making payment to an e-Commerce participant, whichever is earlierIf e commerce participant is a corporate, then TDS u/s 194O is deductible irrespective of the threshold limits.In case of Individuals/HUF, there is no requirement to deduct TDS if the gross amount of sale of goods, services, or both during the previous year does not exceed Rs 5 lakh and if the e-Commerce participant has furnished his PAN or Aadhaar.The threshold limit of INR 500,000 under section 194-O is calculated from 1 April 2020.The liability to deduct TDS or collect TCS applies to payments or credits on or after 1 October 2020.TDS must be deducted at the rate of 5%, as per provisions of Section 206AA if the participant does not furnish his PAN or Aadhaar.

Exception:

No TDS will be deducted if the participant is a non-resident. (In such cases the provisions of “Equalization levy” are applicable.)And if the amount, paid or credited to individuals/HUF during a financial year, does not exceed Rs 5 lakh.

Points to be noted:

In this section “Grosssales” is interpreted as gross sales from e-commerce operator after excluding GST components.Commission of e-commerce operator: It would be logical to deduct TDS on gross sales after excluding commission/service fee of e-commerce operator. TDS u/s 194H would be deducted on such commission.As per act rest all penal, filingand other provisions of the TDS chapter will be applicable.

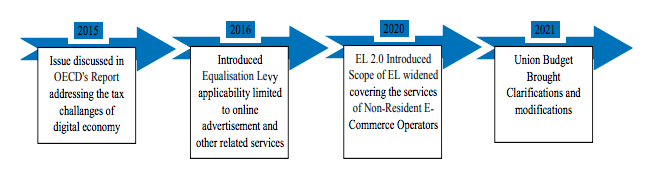

Equalization Levy

EVOLUTION

Transition of Equalization from 2016 to 2021

Equalization Levy Vs TDS under Section 194O- An Interplay

Equalisation levy considers who the buyer on the NR E-Commerce platform is whereas 194-O consider whether the E-Commerce participant i.e. is a resident.

Following is an instance where both the provisions are applicable –

A Buyer, resident in India purchases goods on an E-Commerce platform run by a NR from a seller who is a resident in India. In such a scenario, NR E-Commerce Operator would be liable to pay an equalisation levy @ 2% in India (subject to other conditions of the section being satisfied) and deduct tax @1% u/s 194-O of the ITA from the payment to be made to the seller.

Points to ponder:

EL is would be applicable to intercompany transactions and reseller arrangements. No exemption is provided in this regard.Advice rendered through email or telephone would also constitute digital or electronic facility or platform which is used for online provision of services and therefore can fall within the ambit of e-commerce supply or services, hence liable for equalization levy

GST– TCS

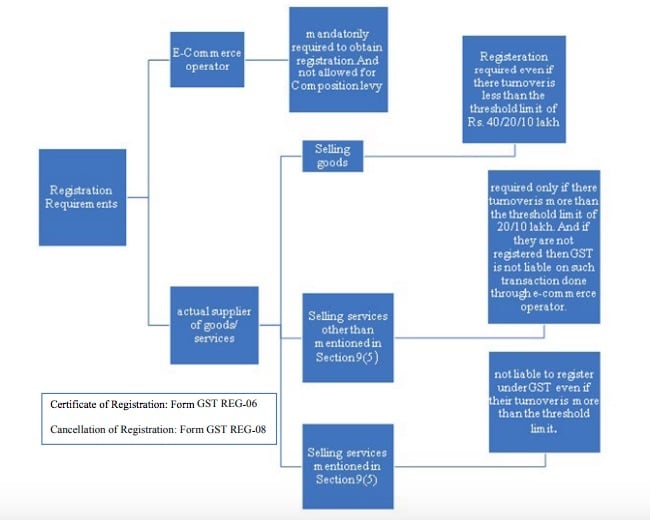

Registration Requirement:

Liability to pay GST

Returns and Compliances

TCS Provision

The dealers or traders supplying goods and/or services through e-commerceoperators will receive payment after deduction of TCS @ 1%.This means for an intrastate supply 1% i.e., 0.5 % under CGST and 0.5% under SGST.between the states, the TCS rate will be 1%, i.e., under the IGST Act.

Non-Applicability of TCS Provisions

TCS provisions are not applicable where GST is payable under RCM.exempt supply.import of goods or servicesNo TCS if you are selling your own products through electronic portala person supplying services, other than services under section 9 (5) were exempted from obtaining compulsory registration provided their aggregate turnover does not exceed threshold limits. Since such suppliers are not liable for registration, TCS provisions do not apply

Time of supply

Between Seller & ECO

TCS is to be collected once supply has been made through the e-commerce operatorandwhere the business model is that the consideration is to be collected by the ecommerce operator irrespective of the actualcollection of the consideration.

For example, if the supply has taken place through the ecommerce operator on 30th October 2018 butthe consideration for the same has been collected in the month of November 2018, then TCS for such supply has to be collected and reported in the statement for the month of October, 2018.

Value of supply

The value of supply for goods and services provided through ECO which are not mentioned in sec 9(5) shall be the net value of taxable supplies. NET VALUE OF TAXABLE SUPPLIES = AGG VALUE OF SUPPLIES THROUGH ECO –SUPPLIES RETURNEDSUPPLIES u/s 9(5).

Credit of tax collected:

The tax collected by the operator shall be credited to the cash ledger of the supplier. The supplier can claim credit of tax collected and reflected in the return by the Operator in his [supplier’s] electronic cash ledger.

Matching of details of supplies:

value of supplies, submitted by every operator in the statements will be matched with the details of supplies submitted by all such suppliers in their returns.If there is any discrepancy in the value of supplies, the same would be communicated to both.If such discrepancy in value is not rectified within the given time,then such amount would be added to the output tax liability of such supplerThe supplier will have to pay the differential amount of output tax along with interest.

TCS Provision

The dealers or traders supplying goods and/or services through e-commerceoperators will receive payment after deduction of TCS @ 1%.This means for an intrastate supply 1% i.e., 0.5 % under CGST and 0.5% under SGST.between the states, the TCS rate will be 1%, i.e., under the IGST Act.

Non-Applicability of TCS Provisions

TCS provisions are not applicable where GST is payable under RCM.exempt supply.import of goods or servicesNo TCS if you are selling your own products through electronic portala person supplying services, other than services under section 9 (5) were exempted from obtaining compulsory registration provided their aggregate turnover does not exceed threshold limits. Since such suppliers are not liable for registration, TCS provisions do not apply

Time of supply

Between Seller & ECO

TCS is to be collected once supply has been made through the e-commerce operatorandwhere the business model is that the consideration is to be collected by the ecommerce operator irrespective of the actual collection of the consideration.

For example, if the supply has taken place through the ecommerce operator on 30th October 2018 butthe consideration for the same has been collected in the month of November 2018, then TCS for such supply has to be collected and reported in the statement for the month of October, 2018.

Value of supply

The value of supply for goods and services provided through ECO which are not mentioned in sec 9(5) shall be the net value of taxable supplies. NET VALUE OF TAXABLE SUPPLIES = AGG VALUE OF SUPPLIES THROUGH ECO –SUPPLIES RETURNEDSUPPLIES u/s 9(5).

Credit of tax collected:

The tax collected by the operator shall be credited to the cash ledger of the supplier. The supplier can claim credit of tax collected and reflected in the return by the Operator in his [supplier’s] electronic cash ledger.

Matching of details of supplies:

value of supplies, submitted by every operator in the statements will be matched with the details of supplies submitted by all such suppliers in their returns.If there is any discrepancy in the value of supplies, the same would be communicated to both.If such discrepancy in value is not rectified within the given time,then such amount would be added to the output tax liability of such supplerThe supplier will have to pay the differential amount of output tax along with interest.