Transfer Pricing Case Studies

Background

XYZ Inc., a fortune 500 Company is in the business of manufacturing of automobilesXYZ India is a 100 % subsidiary and provides CAD designing services.XYZ India is a captive service provider and is compensated on a C + 10 % mark up.XYZ India has applied the TNNM as the Most Appropriate Method using comparables operating in ITeS industry. –PLI applied – Operating Margin / Operating Cost

Analysis Position of the TPO

Rejection of Loss Making CompaniesRejection of Companies having only domestic transactionsRejection of Multiple year dataOwn set of Comparables provided without any search process (cherry picking)Proposed mark up of 30% -40%

Position of the Tax Payer

Loss cannot be the sole criteria for rejection (entrepreneurial risk)TNNM requires functional comparabilityFinancial results of comparables exhibit high degree of variationIntegrated Service Provider to be excludedCompanies having intangibles to be excluded ( unique software, brand name etc)Adjustment for :Working CapitalIntangiblesRisk ( captive service provider Vs. entrepreneur)

Audit Outcome

Captive Service Provider (BPO/ITeS)

–Losses not acceptable –Proposed cost plus markups range from 25% to 40% –“One size fits all” approach –Comparables proposed inappropriate (no consideration for intangibles, differences in business models, etc.) –Justifies markup saying “even after paying high markups, cost savings will be substantial”

Adjustment of risk vis-à-vis third party comparables disallowedWorking capital adjustments of 2% allowed in some cases

Case Study 1 on Transfer Pricing :-

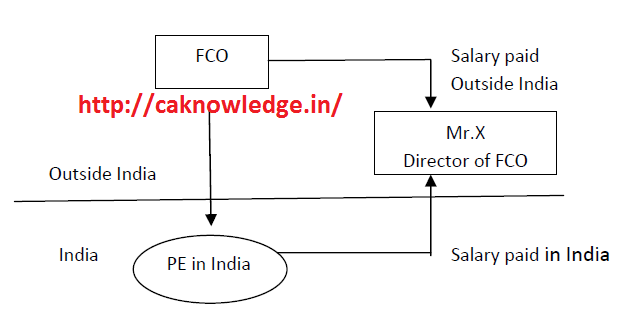

Applicability of SDT to transactions between non‐residents Facts:

Mr. X is director of FCO which has a PE in IndiaMr. X was deputed to work for PE in India from 1 November 2012 during FY 2012‐13.For services rendered upto October 2012, Mr. X was paid salary outside India. For services rendered post 1 November 2012, he is paid salary in India.PE is liable to tax on net basis in India. Mr. X’s status is non‐resident for FY 2012‐13.PE claims salary paid to Mr. post 1 November 2012 as deductible expenditure from its income.

Issue:

Whether salary paid to Mr. X is subject to Domestic TP considering that both FCO (and hence its PE) as also Mr. X are non‐residents?

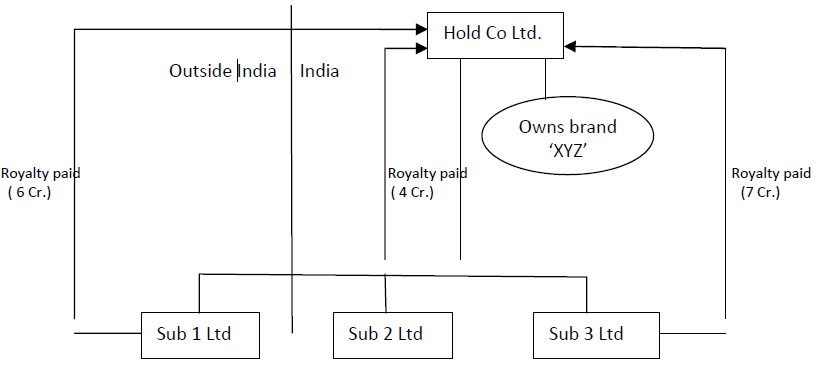

Case Study 2 – Applicability of TP for royalty paid by Indian and foreign subsidiaries to Indian parent Facts:

Hold Co is an Indian company.Sub 1 is a foreign subsidiary. Sub 2 and Sub 3 are Indian subsidiaries.Hold Co. owns valuable brand ‘XYZ’ which is self generated for Hold Co.Hold Co is not eligible for any profit linked tax holidayThe subsidiaries are engaged in manufacturing and distribution of diverse products.The subsidiaries sell their products under brand name of ‘XYZ’.The subsidiaries pay royalty to Hold Co. for use of brand name.Sub 1 has no presence in India and is not liable to tax in India.Sub 2 pays royalty of Rs.4 Cr to Hold Co. Sub 3 pays royalty of Rs.7 Cr to Hold Co. Both Sub 2 and Sub 3 are not entitled to any profit linked tax holiday.

Issue:

Whether Hold Co. is liable for Domestic TP for royalty received from subsidiaries?Whether subsidiaries are liable to Domestic TP?

CASE STUDY 2 on Transfer Pricing

Facts

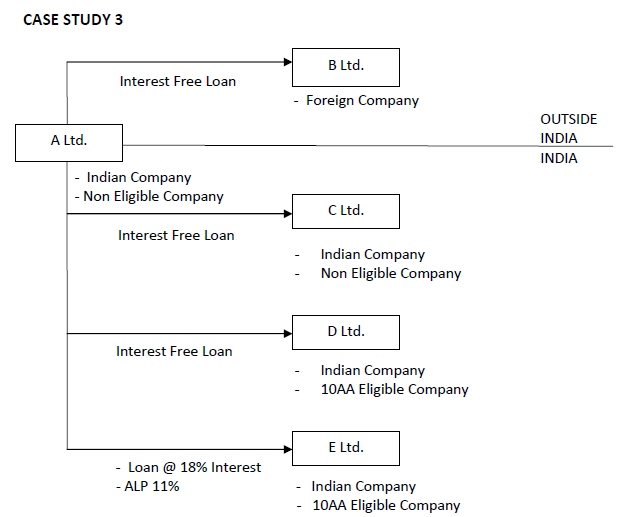

A Ltd. is an Indian company and not eligible for any tax‐holidayB Ltd. is a foreign company located in U.S.A. and 100% subsidiary of A Ltd.C Ltd. is an Indian company, 100% subsidiary of A Ltd., and not eligible for tax‐holidayD Ltd. and E Ltd. are Indian companies, 100% subsidiaries of A Ltd. and eligible for deduction u/s.10AAA Ltd. granted interest free loans to B Ltd., C Ltd. and D Ltd.A Ltd. granted loan to E Ltd. at interest rate of 18% p.a.

Issue What is the effect of Domestic TP in the hands of A Ltd., B Ltd., C Ltd., D Ltd., and E Ltd.? B Ltd. A Ltd. C Ltd. D Ltd. E Ltd.

CASE STUDY 4 on Transfer Pricing

CASE STUDY 5 on Transfer Pricing

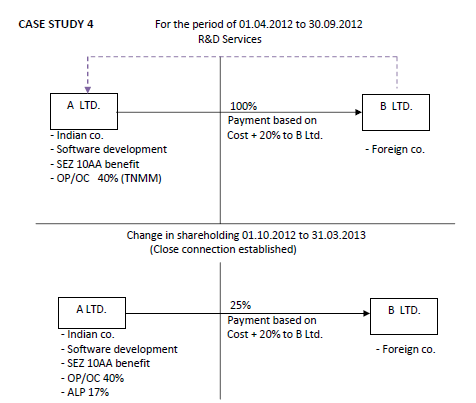

Facts

A Ltd. is an Indian company engaged in software development and eligible for section 10AA benefitB Ltd. is a wholly owned subsidiary of A Ltd. situated in China and provides R & D services to A Ltd.B Ltd. charges cost plus 20% mark‐up for providing R & D services to A Ltd.With effect from 01.10.2012, shareholding of A Ltd. in B Ltd. was reduced to 25%A Ltd. has earned OP/OC of 40% from 01.04.2012 to 30.09.2012 as well as from 01.10.2012 to 31.03.2013. Arm’s length OP/OC is 17%

Issues

During F.Y. 2012‐13, whether A Ltd. will be subject to International TP or Domestic TP or both?In Domestic TP, whether transactions will be covered u/s. 40A(2) or 80‐IA(10) or both?Whether any upward adjustment can be made for A Ltd. by the AO under Domestic TPProvisions even though there is mere change in the shareholding without any change in the pricing mechanism of transactions with related party?

Recommended Articles

CA Final Suggested AnswersCA Final ResultCA Final Time TableCA Final Admit CardICAI Exam FormCA Final Audit NotesCA Final AMA NotesCA Final IDT NotesCA Final Law NotesCA Final DT NotesCA Final SFM NotesCA Final FR NotesCA Final RTPCA Final Mock Test Papers